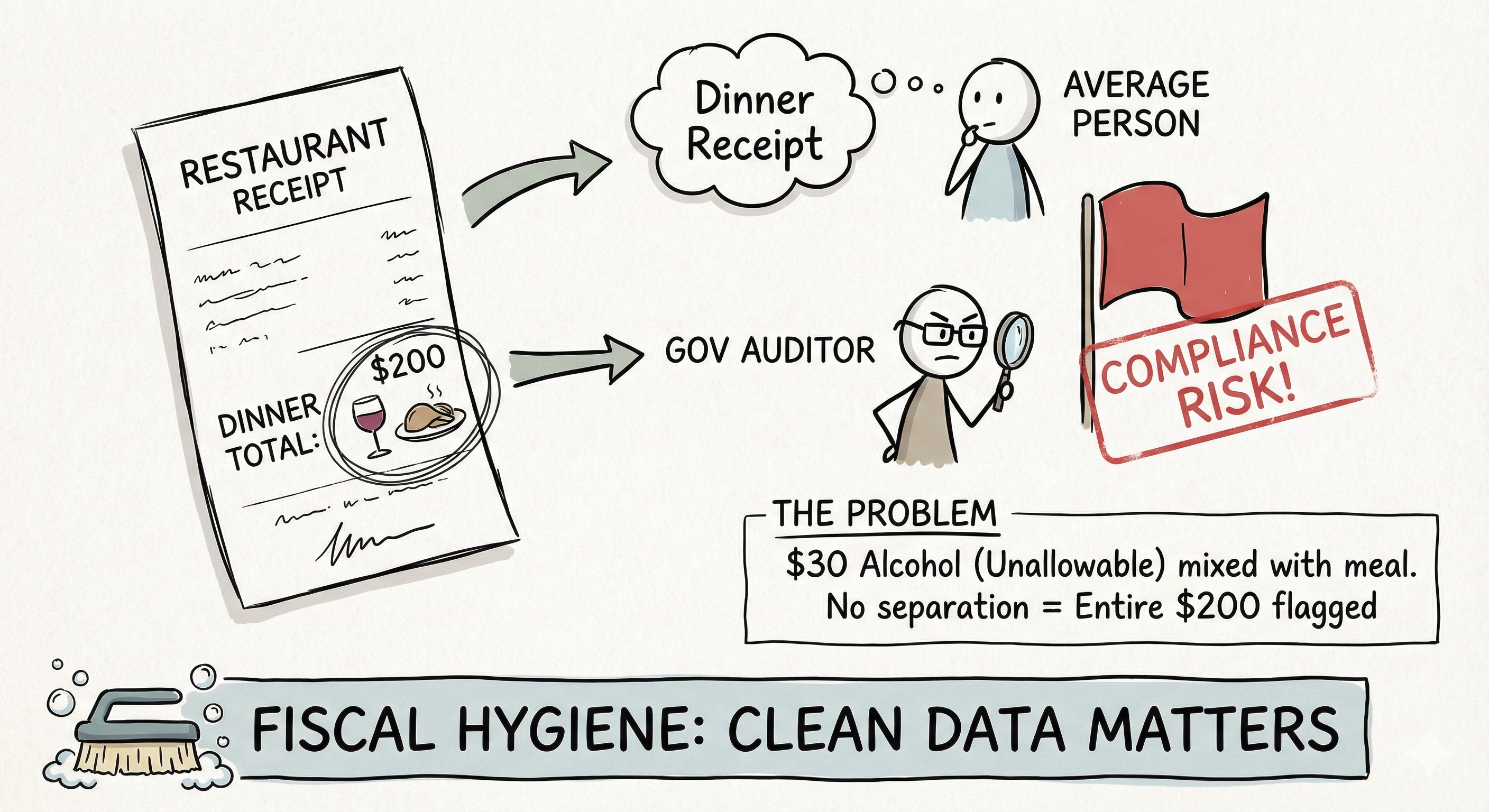

It seems like a small detail: A $200 team dinner invoice that includes $30 for alcohol. No itemization, just one total sum.

To the average person, it’s a dinner receipt. To a Government Auditor, it’s a compliance risk.

Because that $30 was not segregated from the allowable meal costs, the entire $200 voucher is now questionable. This is why accountants and auditors are often accused of being "obsessive" or having "financial OCD."

But in the world of Government Auditing, this isn't fussiness—it's Fiscal Hygiene.

Why "Clean" Data Matters:

- Unallowable Costs: Regulations (like FAR in the US) strictly separate alcohol from reimbursable expenses.

- Audit Trails: A "mixed" receipt breaks the chain of evidence.

- Risk Mitigation: One flagged receipt can trigger a wider probe into company spending.

Auditors aren't looking for problems; they are ensuring the "purity" of the ledger. Being a "cleanliness freak" isn't a quirk in our industry—it's the job description.